Expenses

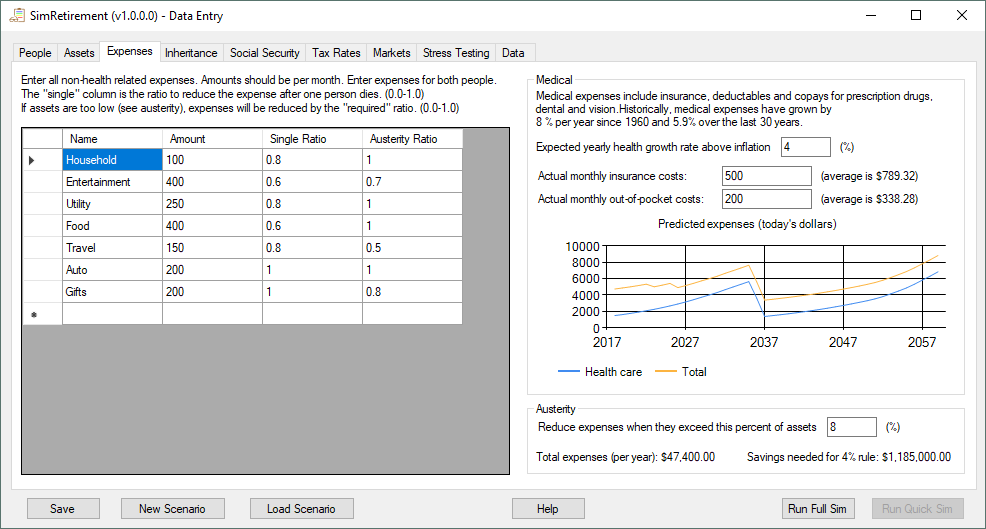

The expenses page allows you to enter all your monthly expenses. You may enter all your expenses together on one line, or you can break up the expenses into whatever categories you want.

The Amount column should contain the monthly dollar amount of the expense.

The “Single Ratio” column is the portion of the expense that would still be paid after one member of a couple dies. For example, you might have a grocery expense that would go down if your spouse died. If you thought that groceries for a single person would cost 60% of what a couple spends, you would enter 0.6 in the “Single Ratio” column. A single person should set these all to 1.0.

The “Austerity Ratio” column works like the “Single Ratio” column to reduce expenses, but this reduction occurs if your expenses exceeds a percent of your assets. For example: you might have an entertainment expense that you could cut back by 30%. You would then set the “Austerity Ratio” to 0.7.

You can set the percent of assets that expenses need to exceed to trigger this reduction in the “Austerity” area on the right side of the screen. The default value is 6%. This default is 50% more than the “4% rule” which says you can retire if your expenses are 4% of your assets.

Medical expenses are treated differently. Normal expenses are increased by inflation each month. Medical expenses can be increased by a different amount (set to inflation+4% by default) since medical expenses have been growing faster than inflation in recent years.

If you are less than 65, enter your current insurance and expected out of pocket costs. If you are over 65, the simulation assumes that you are on Medicare.

The plot will show how your medical costs will change over time. The chart shows costs in today’s dollars and takes into account the medical inflation rate and the fact that medical costs increase with age. If you are currently under 65, you will also see a discontinuity in the graph where you (and your spouse) start Medicare.

If you have an HSA asset, out-of-pocket costs will be paid out of that account.

Next tab: Inheritance