Social Security

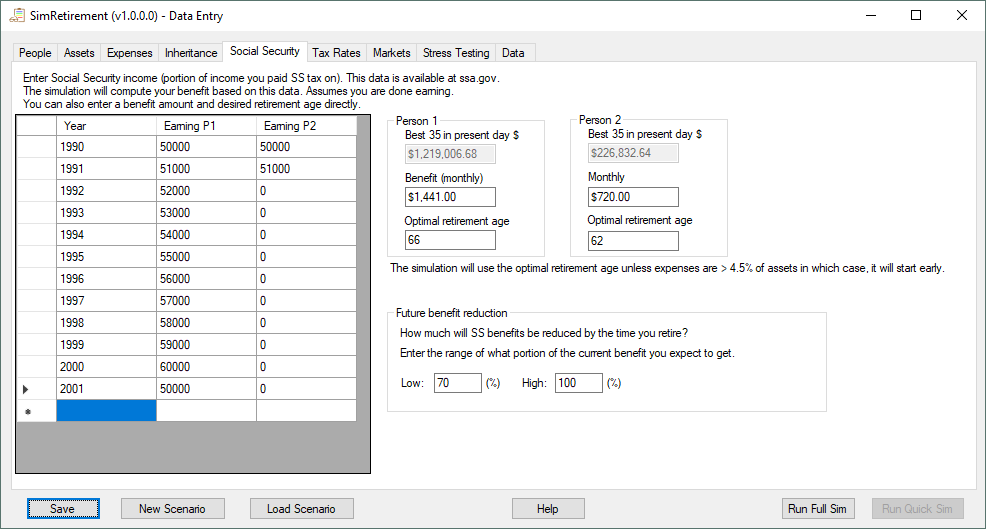

There are two ways to enter your social security benefit. You can enter all your yearly social security earnings as reported on your social security yearly report. The program will then calculate your benefit and the optimum retirement age. You can also skip entering yearly earnings and just enter your benefit directly. The default is to enter all your earnings. Check the “Enter benefit manually” button to override.

You might want to take the time to enter all your yearly earnings. If you have earned money in the last few years, the Social Security Administration will assume that you will continue to earn money at the current rate when estimating your future benefit. If you are planning to retire and stop earning money today, their benefit estimate will be too high.

If there are two people being simulated, the program will use the greater of their actual benefit and one half of their spouses benefit. This presumes that the couple is legally married (or once was and haven’t remarried). If the spouse doesn’t qualify for whatever reason, you should override the benefit value.

Once you have entered your monthly social security benefit, you also need to estimate any future reductions in social security payments. As of 2017, the social security trust fund is predicted to be exhausted in 2034. If there are no changes to the law, when the fund is exhausted, payments will fall 21%. Of course it is nearly impossible to predict what will happen as the trust fund runs out of money. It is possible that benefits will be cut, retirement ages increased, or the yearly inflation adjustment put on hold. It is also possible that taxes will be raised or debt issued to keep the payments going at current levels. The software allows you to enter a range of benefits you think are possible. The simulation will choose a random value within that range for each run.

The program will calculate the “optimal” time to start social security. This calculation is based on several factors:

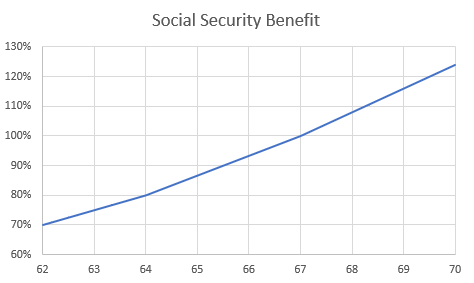

- The amount that your Social Security benefit increases by delaying benefit start: 100% at 67, 5/12% penalty each month from ages 62-64, 5/9% penalty each month from 64-67, and an 8% bonus per year after 67.

- Your life expectancy. Assuming you are alive at 62, each year there is some percent chance that you will still be alive to collect the benefit.

- A discount rate to represent the time value of money. There is some debate about what rate to use to value social security payments. This program assumes a rate of 4% above inflation since taking social security is probably keeping a retiree from spending money that is invested in stocks and bonds. See this page for a complete discussion.

If you plan to start social security at a particular age, click the “Enter benefit manually” button and type in the age you want to start.

During the actual simulation, the program will start social security at the pre-calculated “optimal” age unless you are running short on money in which case it will start earlier.

Next page: Tax Rates