People

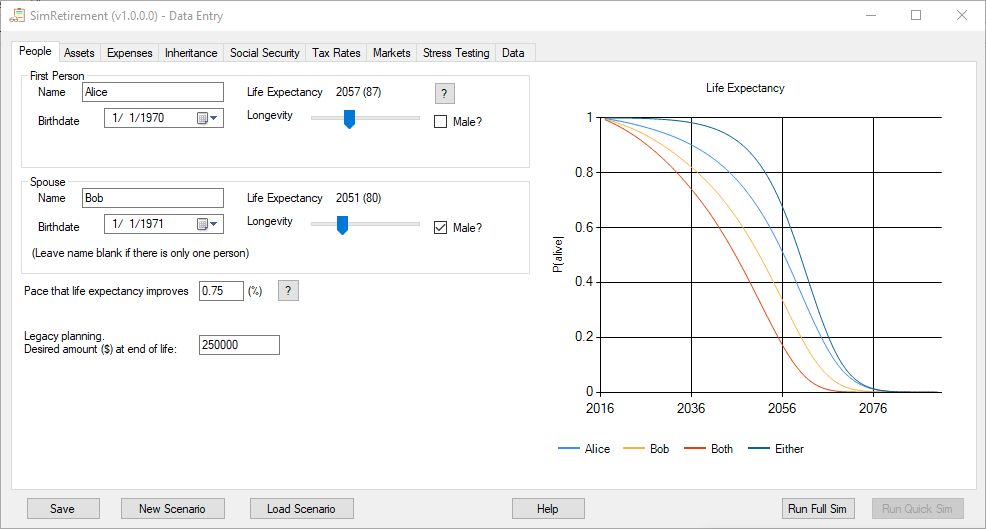

When the program starts, you will be presented with a data entry window. The first page that you should fill out is the “People” page.

If there is only one person, just fill out the “First Person” box. If you are a couple, fill out the “Spouse” box too. For each person, enter their name, birthday, whether they are a man or woman and adjust the “Longevity” slider so that the life expectancy matches what you want. I’d recommend using an online longevity calculator, but the program provides some basic guidance if you click the “?” next to “Life Expectancy”

The “life expectancy improvement factor” is a percentage that life expectancy improves every year due to medical advances. Over the last 50 years life expectancy has been improving at a rate of 0.75% per year. This is especially important if you are retiring early. You can change this value if you think medical science will improve faster or slower than in the past.

Finally, you can enter an amount of money that you would like to have at the end of the simulation (when all the people have died). This could be an inheritance for children or other legacy. When you set a value for a desired legacy, the result window will show a “Failure” if you run out of money before you die and a “Failed to fund goal” if you died with less money than your legacy plan. This amount is in today’s dollars and will be adjusted for inflation during the simulation.

Note: The longevity slider can only increase your life expectancy so much. Any scenario where you would expect to live more than 120 years can’t be handled by this program.

Example: Alice and Bob are a couple born in 1970 and 1971. Bob has a family history of heart problems and so has lowered his life expectancy slider. They want to leave $250,000 to a local charity when they die. Next tab: Assets

Next tab: Assets