Tax Rates

The simulation computes taxes each year based on the dividends you earn, annuity and social security income and any capital gains generated when selling stocks/bonds to pay expenses. The simulation assumes that you don’t have any other income or deductions. You can use the Tax Rates page to keep the simulation up to date with yearly changes to tax brackets and deduction amounts. You can also use this page to alter how the simulation calculates taxes to take into account your personal situation.

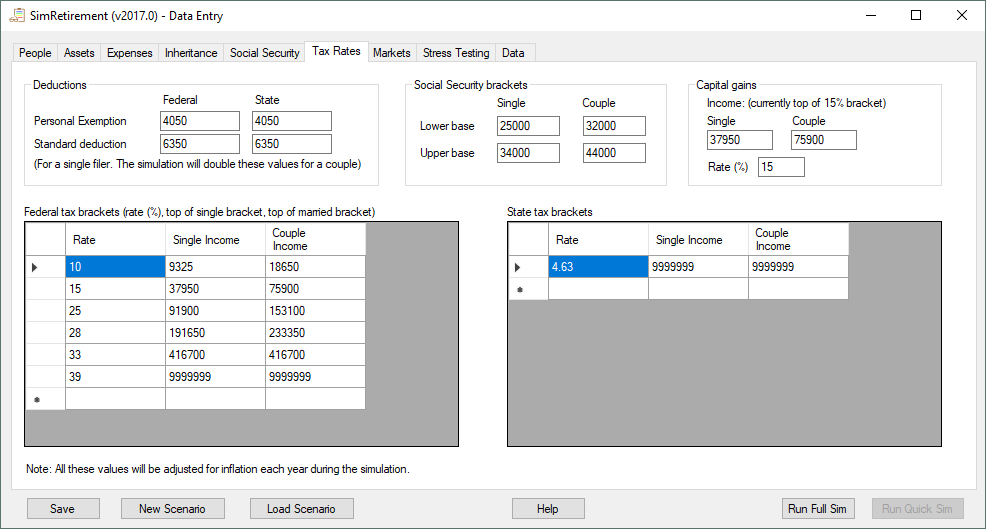

The Deductions section allows you to enter deductions to your income. This is broken out into a personal exemption and standard deduction for convenience. In reality, these values are just added together and then doubled if you are a couple.

The Deductions section allows you to enter deductions to your income. This is broken out into a personal exemption and standard deduction for convenience. In reality, these values are just added together and then doubled if you are a couple.

The Social security section allows you to enter the amount of income before social security income is taxed at 0.50/dollar and then at 0.85/dollar (see below for how taxes on social security are calculated).

The capital gains section allows you to enter the amount of money that a single person and couple need to earn before their capital gains start to be taxed and the rate at which those gains are taxed. Under current law, capital gains start to be taxed at 15% if you are in the 25% bracket. The simulation ignores the situation where capital gains can be taxed at 20% if you are in the top bracket.

The simulation computes state taxes with the same logic that is used for federal taxes while allowing different values for the standard deduction and tax brackets. If your state has different tax laws, you can set these values to approximate your state taxes. For example, in a state with no taxes, you could set the standard deduction to 100,000,000.

The default values for state taxes is for a state that charges a flat 4.63%. If your state has a flat rate, just enter your state’s tax rate in the rate column. If you state has brackets like the federal government, enter your state’s brackets. If your state uses a different method for taxes, try to approximate your state tax with the deductions and brackets system.

Note: The simulation will adjust all these values for inflation during a run. This matches current law except for the social security brackets which aren’t currently inflation indexed.

Here is the simplified logic the simulation uses to compute taxes:

- Determine how much of your social security is taxable (ss stands for socialSecurity)

- ssIncome = normalIncome + capitalGains + ssIncome/2

- if ( ssIncome > ssUpperBase ) then taxableSS = min(ssIncome*0.85, (ssUpperBase-ssLowerBase)*0.5+(ssIncome-ssUpperBase)*0.85

- else if (ssIncome > ssLowerBase ) then taxableSS = min(ssIncome*0.5, (ssIncome-ssLowerBase)*0.5

- Figure deductions: deductions = numPeople*(standardDeduction + personalExemption)

- Calculate AdjustedGrossIncome: agi= normalIncome + capitalGains + ssIncome – deductions

- Calculate tax on normal income

- normalIncome = agi – captialGains

- loop over all tax brackets (a tax bracket has a min-max dollar range and a rate)

- tax = tax + bracket.rate * min(bracket.max-bracket.min, max(0, normalIncome-backet.min))

- Add capital gains tax

- if ( agi > CapitalGainIncomeAmount)

- if ( agi – capitalGains > CapitalGainIncomeAmount) tax = tax + CapitalGainRate*capitalGains

- else tax = tax + CapitalGainRate*(captialGains – min(CapitalGainIncomeAmount, CapitalGainIncomeAmount- normalIncome))

- if ( agi > CapitalGainIncomeAmount)

- Add state taxes (very few states tax social security income)

- loop over all state tax brackets

- stateIncome = normalIncome + capitalGains – deductions

- tax = tax + bracket.rate * min(bracket.max-bracket.min, max(0, agi-backet.min))

Next Page: Markets